Food and Beverage Manufacturing in Australia: Building Resilient Plants for 2030

From reputation to operational resilience

Food and beverage manufacturing in Australia is entering a new phase. The 2030 ambition is still clear: a larger, smarter, more export-oriented sector with stronger traceability and higher value-add processing. What has changed is the day-to-day operating reality.

Labour shortages, cost volatility and rising sustainability requirements are pushing manufacturers to rethink how every line runs, every shift. The race to 2030 is no longer just about launching new products. It is about building resilient production systems that protect food safety, maintain reliability, and keep “Australian made” competitive under pressure.

Why 2030 looks different for Australian food manufacturing

Industry strategies continue to emphasise modern manufacturing, digital capability and greater onshore processing. In practice, that means more sensor-driven production, tighter process control and higher automation across existing facilities.

At the same time, manufacturers are dealing with three compounding forces:

- Persistent labour shortages across processing and packaging operations

- High and volatile energy and input costs

- Stricter requirements from retailers and export markets around consistency, traceability and compliance

Together, these pressures are accelerating the shift away from manual, labour-intensive processes toward automated, data-led operations where uptime, energy use and quality are managed in real time.

Poultry as a pressure test for throughput and uptime

Poultry is a useful proxy for what is happening across the sector, because growth and operational pressure collide in a very visible way. ABARES has forecast the value of poultry processing rising to $4.2 billion in 2025–26, reinforcing poultry’s position as a major production category and a high-throughput, low-tolerance environment.

Alongside this growth, ABARES has been commissioned to conduct an independent review of relationships between growers and integrated producers in the chicken meat supply chain, reflecting the increased scrutiny that comes as production scales.

On the factory floor, this shows up as:

- Higher throughput targets through core processing stages and further processing

- Tighter control of water, temperature, hygiene and handling at each step

- Minimal tolerance for unplanned downtime in critical supporting systems

The key point is simple: high-volume food manufacturing only works when the background utilities stay stable.

Smart factories depend on stable air systems

As automation becomes standard across mixing, dosing, filling and packaging, smart factory capability increasingly depends on the reliability of “invisible” plant systems. Sensors and controls can only stabilise production if the underlying utilities deliver consistent, predictable performance.

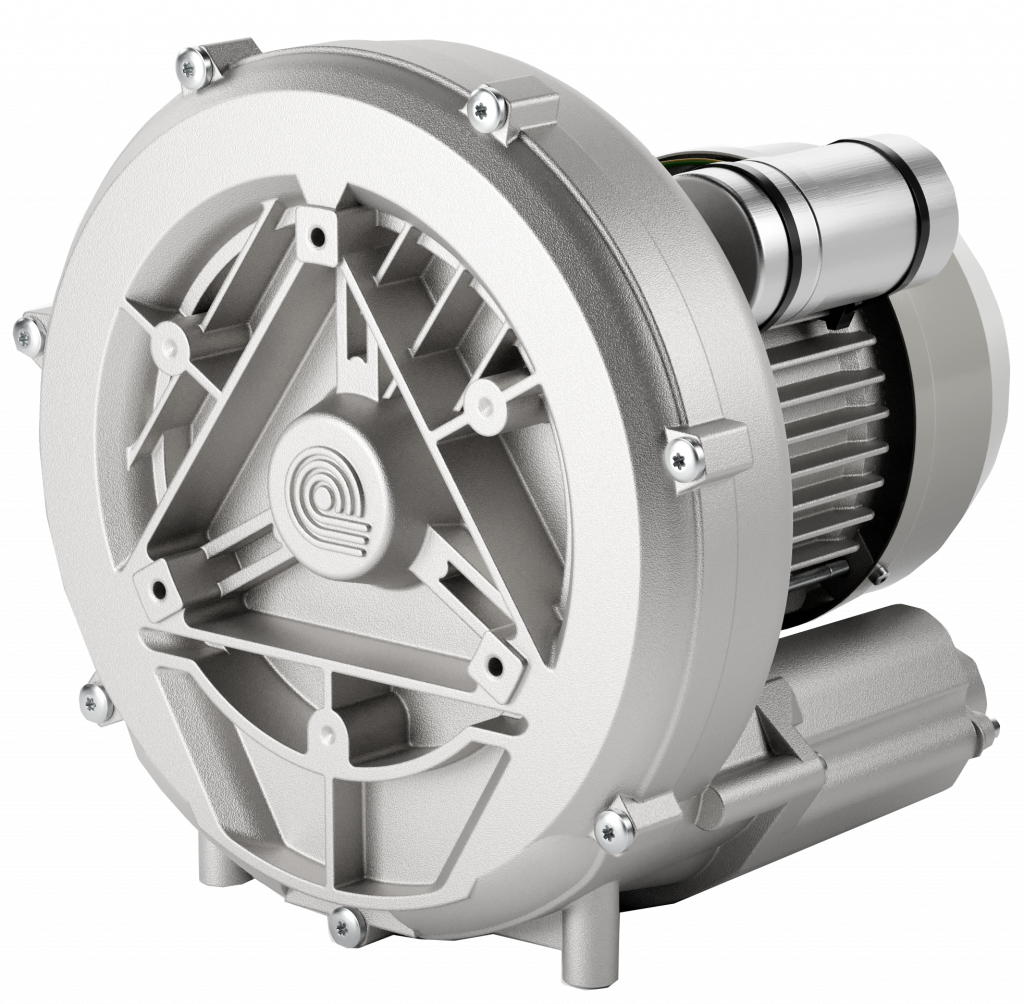

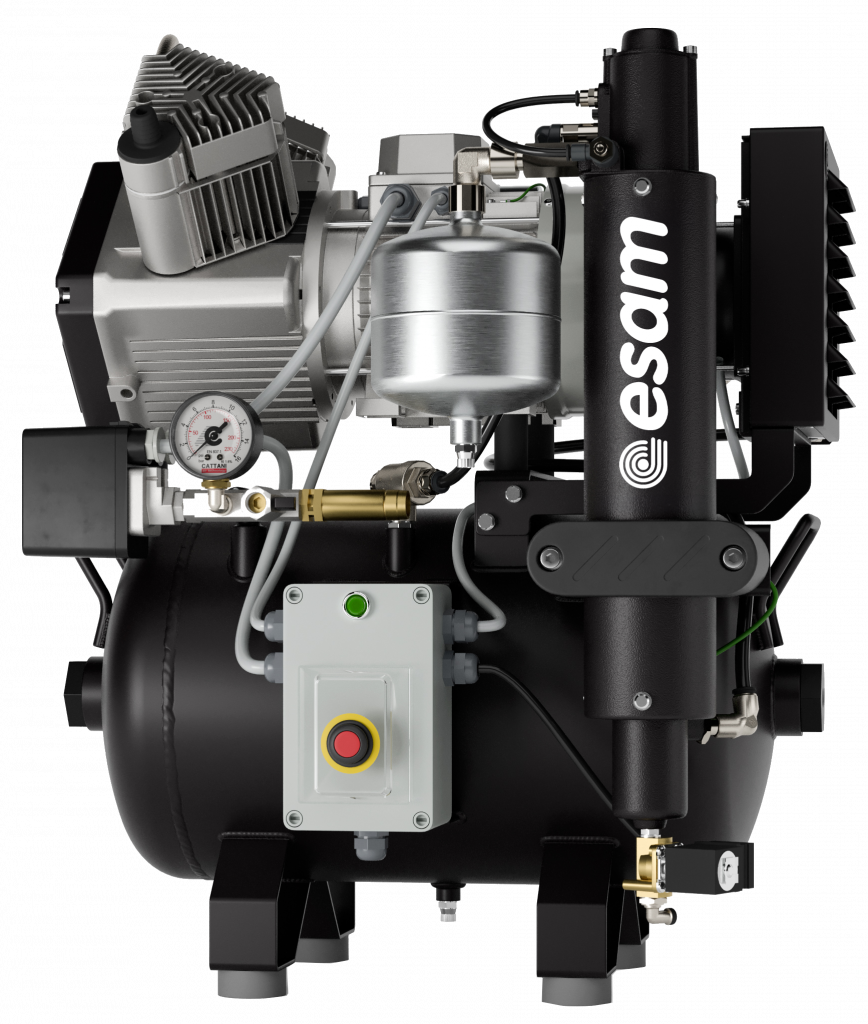

Air is one of the most important utilities in modern food and beverage manufacturing. Across plants, side channel blowers and oil-free compressed air commonly support:

- Pneumatic conveying of ingredients and packaging materials in enclosed, hygienic systems

- Aeration and agitation in tanks, process water systems and washdown-related applications

- Air blow-off, drying and vacuum applications on high-speed packaging lines

In this context, “smart air” means stable pressure and flow, and operation that is quiet, efficient and suitable for controlled processing environments. When air systems are under-specified or unstable, the result is not just inefficiency. It can become downtime, quality drift, or hygiene risk.

Sustainability and efficiency gains start with utilities

Sustainability expectations in Australian food manufacturing have moved from brand messaging to procurement reality. Manufacturers are being pushed to reduce energy and emissions intensity while improving traceability and reporting confidence, particularly where customers and export partners demand evidence.

Utilities upgrades are often among the fastest pathways to measurable improvement. More efficient blowers and compressors can:

- Reduce energy consumption in conveying, aeration and drying applications

- Improve process consistency, cutting waste and rework

- Reduce noise and vibration, supporting longer equipment life and safer working environments

Australia’s National Greenhouse and Energy Reporting (NGER) framework reinforces the broader shift toward more structured reporting on emissions and energy use for organisations that meet reporting thresholds. Even where a manufacturer is not directly captured by NGER thresholds, expectations around data quality and reporting discipline are spreading through supply chains.

Translating 2030 strategy into practical upgrades

The next three to five years for many Australian plants will be about modernising existing sites rather than building new ones. That typically means replacing ageing utilities, adding sensors and controls, and incrementally automating high-risk or high-labour tasks.

This is where specialist air technology partners matter. Well-specified side channel blowers and oil-free compressors can enable:

- More reliable and controllable conveying, aeration and vacuum performance

- Lower contamination risk in hygienic and high-care zones

- Fewer unplanned stoppages through robust, low-maintenance design

If you’re planning upgrades to conveying, aeration or packaging utilities, our technical team can review your current air requirements and recommend a fit-for-purpose blower or oil-free compressor setup for continuous operation and hygienic environments.

Contact our technical team on +61 3 9484 5719

Sources and references

Reports and Industry Strategy

Australian Food and Grocery Council. Sustaining Australia: Food and Grocery Manufacturing 2030. Canberra: AFGC, 2021. https://afgc.org.au/wp-content/uploads/2024/10/Sustaining-Australia-2030-Report-2.pdf

Australian Food and Grocery Council. Food and Grocery Export Growth Strategy 2030. Canberra: AFGC, 2023. https://afgc.org.au/wp-content/uploads/2024/10/Food-and-Grocery-Export-Growth-Strategy-2023-Final.pdf

Department of Industry, Science, Energy and Resources. Food and Beverage Road Map: National Manufacturing Priority. Canberra: Australian Government, 2021. https://centralcoastfoodalliance.com.au/wp-content/uploads/2021/04/food-and-beverage-national-manufacturing-priority-road-map.pdf

Data and Government Updates

Australian Bureau of Agricultural and Resource Economics and Sciences. “Agricultural Commodities Report: September 2025.” Department of Agriculture, Fisheries and Forestry. 5 September 2025. https://www.agriculture.gov.au/abares/research-topics/agricultural-outlook/september-2025

Australian Bureau of Agricultural and Resource Economics and Sciences. “ABARES Australian chicken meat industry review.” Department of Agriculture, Fisheries and Forestry. 7 November 2025. https://www.agriculture.gov.au/abares/research-topics/chicken-meat-supply-chain-review

Department of Agriculture, Fisheries and Forestry. “ABARES to conduct chicken meat industry review.” Australian Government. 28 March 2025. https://www.agriculture.gov.au/about/news/abares-chicken-meat-industry-review

Regulation and Reporting

Clean Energy Regulator. “National Greenhouse and Energy Reporting Scheme.” Clean Energy Regulator. 12 January 2026. https://cer.gov.au/schemes/national-greenhouse-and-energy-reporting-scheme